In the span of just a few years, the term “Web3” has gone from obscure jargon to a tech buzzword that dominates boardroom conversations, LinkedIn think pieces, and startup pitch decks. But amid the noise, a critical question persists: Is Web3 just another hype cycle, or does it present a genuine business opportunity?

While the initial narrative was fueled by speculative assets like NFTs and meme coins, the underlying architecture of Web3—decentralization, tokenization, and user ownership—is now being reassessed by enterprises and startups alike. This article explores the real-world business case for Web3, shifting the focus from hype to actual application.

Understanding Web3: A Quick Primer

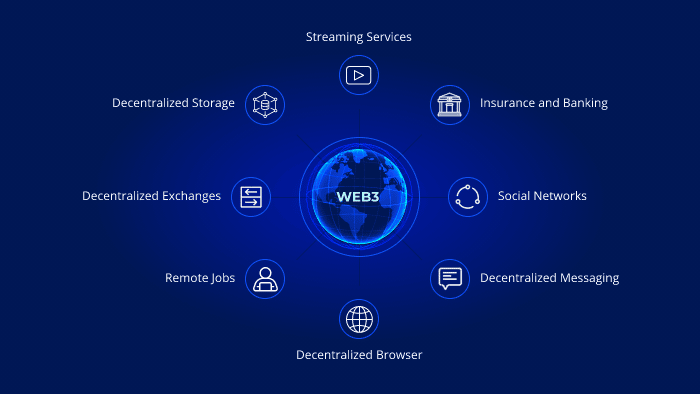

Web3 refers to the next iteration of the internet, built on blockchain and decentralized technologies. Unlike Web2, which is characterized by centralized platforms (think Google, Facebook, Amazon), Web3 is designed to give users control over their data, identity, and participation in digital economies.

Core components include:

- Smart Contracts: Self-executing agreements coded on the blockchain.

- Decentralized Applications (dApps): Platforms that operate without centralized control.

- Tokens: Digital assets representing ownership, access rights, or utility within ecosystems.

- Decentralized Autonomous Organizations (DAOs): Community-led governance models.

Web3’s Business Potential: Not Just for Crypto Startups

1. Redefining Customer Engagement and Loyalty

Web3 opens new channels for customer engagement. Traditional loyalty programs are often fragmented and difficult to scale across ecosystems. With tokenization, brands can offer interoperable loyalty tokens that consumers can trade, stake, or use across different platforms.

Example: Starbucks’ Odyssey loyalty program uses blockchain technology to issue NFTs that represent exclusive benefits and experiences. This moves beyond points systems toward experiential and community-driven engagement.

2. New Revenue Streams via Token Economies

Web3 introduces programmable economics, enabling companies to monetize previously intangible interactions. Through NFTs, digital collectibles, or utility tokens, businesses can create micro-economies within their platforms.

Case in Point: Gaming companies like Epic Games and Animoca Brands are experimenting with tokenized in-game assets that players can own and trade, generating secondary-market value while increasing user stickiness.

3. Decentralized Finance (DeFi) as a Corporate Finance Tool

While DeFi started as a consumer-focused financial alternative, businesses are beginning to explore its potential for treasury management, liquidity pooling, and asset tokenization.

Companies can access:

- Borderless loans without intermediaries

- Higher yield staking options for idle assets

- On-chain financial instruments with transparent audit trails

This disintermediation cuts costs and increases transparency—a major plus in finance-heavy industries like real estate, logistics, or insurance.

Enterprise Applications: Web3 in the Real World

Supply Chain Transparency

Web3-based systems like VeChain are revolutionizing supply chains by offering immutable tracking, product authentication, and verifiable ESG (Environmental, Social, Governance) metrics. This isn’t theoretical—luxury brands, pharmaceutical companies, and agribusinesses are already integrating blockchain into their logistics systems.

Identity and Access Management

Web3’s self-sovereign identity (SSI) systems can replace traditional login/password combinations with decentralized identifiers (DIDs). This strengthens cybersecurity and reduces data liability for businesses.

Intellectual Property & Licensing

NFTs and smart contracts can automate IP licensing, royalty payments, and digital rights management. In industries like music, publishing, and art, this reduces legal complexity while ensuring creators get paid fairly and promptly.

The Roadblocks: What’s Holding Businesses Back?

Despite the promise, Web3 adoption is not without friction.

1. Scalability and User Experience

Many blockchain networks still struggle with transaction speed, cost, and ease of use. For enterprise-scale operations, the technology must evolve to match the seamless experience Web2 offers.

2. Regulatory Uncertainty

Businesses are wary of launching Web3 projects due to unclear regulatory frameworks, particularly concerning token classifications, cross-border finance, and data protection.

3. Lack of Talent and Expertise

Web3 development requires a deep understanding of blockchain, cryptography, and decentralized logic. There is currently a global shortage of qualified developers and consultants who can bridge the gap between enterprise needs and decentralized design.

How Businesses Can Start: A Phased Approach to Web3 Integration

Rather than going “all in,” businesses can adopt Web3 technologies incrementally:

- Tokenized Loyalty Programs – Begin with Web3-lite use cases like NFTs or rewards.

- Smart Contract Automation – Explore smart contracts for internal workflows or external partnerships.

- Experiment with DAOs – Pilot decentralized governance for community-driven projects or subsidiaries.

- Join Ecosystems – Partner with existing dApp projects, wallets, or blockchains instead of building from scratch.

Key Tip: Focus on use case, not technology. Web3 should solve real business problems—not just tick a trend box.

Conclusion: From Skepticism to Strategy

Web3 may have arrived amid hype, but its business applications are starting to prove themselves in measurable ways. Forward-looking companies are no longer asking if they should explore Web3—but how and where it fits into their long-term strategy.

As infrastructure matures, regulations clarify, and user education grows, the lines between traditional digital platforms and decentralized systems will blur. Businesses that invest early—strategically and pragmatically—stand to benefit not just from a technological edge, but from a more participatory, transparent, and efficient digital future.