Venture capital has become a powerful filter for crypto investors, but it is far from the only one. A recent survey shows a community split between those who treat VC backing as a green light and those who still trust their own research more than institutional money.

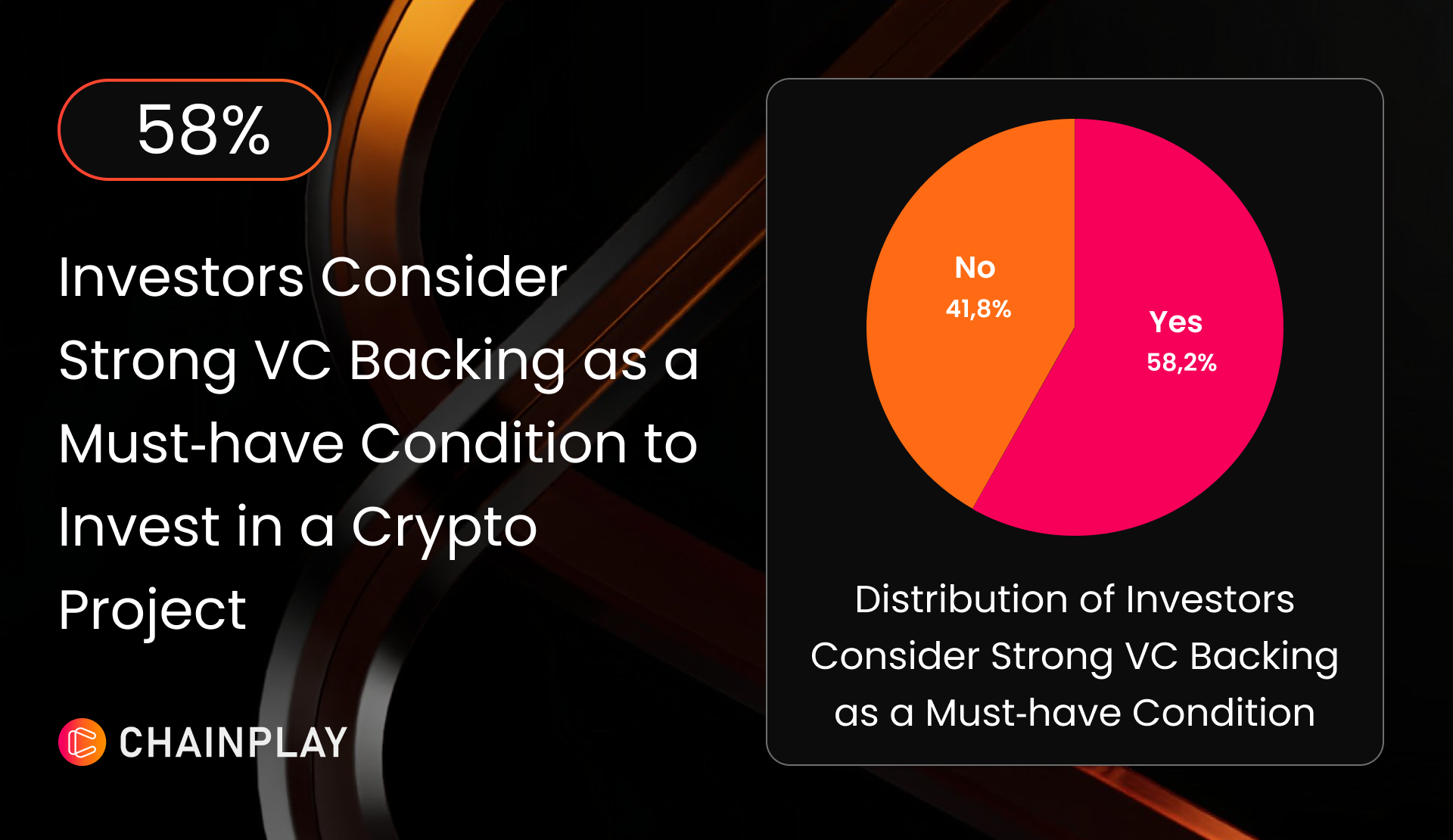

58% of Investors Consider Strong VC Backing as a Must‑have Condition to Invest in a Crypto Project

While a striking 56.72% of VC-backed crypto projects have failed, for 58% of investors, having strong VC backing is still a must‑have condition when considering a crypto project. They view big‑name funds as gatekeepers that screen out weak teams and push projects through professional due diligence.

Among these investors, 42% say VC backing matters primarily because it increases the likelihood of exchange listings and marketing exposure—key factors in securing token liquidity. Meanwhile, 38% view VC participation as a strong signal of credibility and thorough project vetting.

The case against relying on VCs

The case against relying on VCs

Yet 42% of surveyed investors say strong VC backing is not a must‑have requirement at all. Instead of outsourcing judgment, 70% of them (~29% overall) rely primarily on their own research and on‑chain data to understand a project’s fundamentals, token flows, and real user activity.

Within this skeptical camp, 14.6% explicitly prefer community‑driven or highly decentralized projects where no single fund can dominate governance. A further 12.2% believe that early‑stage projects without VC money often offer better return potential, precisely because they are higher risk and not yet crowded with institutional capital.

VCs still shape how investors perceive risk once real money is on the table. According to the data, 68% of investors feel confident about a project’s credibility when it has raised more than 5 million dollars, seeing this threshold as proof that professional backers have committed serious capital. Larger rounds imply a longer runway for development, better access to talent, and more resources for security audits and compliance, all of which help reduce perceived downside.

However, this confidence can create a halo effect, where investors overlook critical red flags simply because “big funds are in.” The same mechanisms that make large raises reassuring can also fuel overcrowded entries, where latecomers buy tokens at inflated valuations while early insiders sit on large, locked allocations.

60% of Investors Have Experienced FOMO After Top-Tier VC Backing

This data highlights how top-tier VC involvement triggers FOMO in crypto markets. Renowned funds such as a16z or Paradigm act as institutional credibility signals, often replacing individual due diligence for many investors.

Because retail participants lack access to private information like pitch decks or internal vetting, VC logos become a dominant heuristic for project quality. This social proof spreads rapidly across Twitter and Discord, amplifying herd behavior during funding rounds or token launches.

The risk is structural: VC-backed hype can inflate valuations beyond fundamentals. When momentum fades, late FOMO-driven investors are often left exposed as early backers exit through liquidity events.

57% Investors Feel Most Confident When Top‑tier VCs Join In A Strategic Round

The survey also asked which funding stage makes investors feel most confident when a top‑tier VC joins. While the exact distribution across seed, private, and public rounds is not detailed in the brief, the question itself highlights a key tension: investors want VCs to be early enough to add value, but not so early that retail ends up holding exit liquidity at listing. Many prefer to see recognizable funds enter around strategic or early private rounds, where tokenomics and governance are still flexible and where investor interests can be aligned through vesting and lockups.

This nuance shows that retail participants are becoming more sophisticated. They no longer just ask “Is there a VC?” but “When did the VC come in, on what terms, and how does that affect my upside and unlock risk?”

What makes a VC Credible?

What makes a VC Credible

Overall, the responses show a very clear hierarchy of what makes a VC “credible” in the eyes of crypto investors.

Investors care about proof, not promises, when judging VC credibility. The two strongest signals are a clear history of backing projects that actually gained users or exited, and a long presence in the market that survived multiple bull–bear cycles. In short, trust comes from VCs that repeatedly picked real winners—not ones showing good numbers on paper only.

The next set of factors still matters, but more as nice-to-haves. These include high ROI, a reputation for spotting early winners, strong connections, and public visibility. Investors like good returns and strong networks, but they mainly see them as tools that help winners grow, not as replacements for a solid track record.

Interestingly, hands-on support and integrity or fairness reputation rank the lowest. This suggests many crypto investors mainly view VCs as signals of quality and upside, not long-term partners. For projects, highlighting a VC’s cycle-tested history and real market wins will likely resonate more than focusing on soft value or mentoring narratives.

What this means for crypto investors

Taken together, the findings paint a picture of a market that respects VC signals but is increasingly unwilling to follow them blindly. A majority still view strong backing as a powerful filter and a gateway to listings, marketing, and professional support, yet a large minority builds conviction through independent research, on‑chain evidence, and alignment with grassroots communities.

For investors, the practical takeaway is clear: VC participation can be a starting point, not an investment thesis on its own. Evaluating who the funds are, when they entered, how much was raised, and how tokens unlock is just as important as reading the pitch deck. In a market where both heavily funded and purely community‑driven projects can succeed or fail, combining institutional signals with personal due diligence remains the most balanced approach.

The post Over Half of Investors Still Consider Strong VC Backing as a Must‑have Factor appeared first on Ventureburn.