P2P crypto trading keeps getting popular. People want more control, cheaper trades, and options when it comes to payments. By 2026, top lowest fees crypto exchange really stand out for P2P trading. They back up every trade with solid escrow, support a bunch of fiat currencies, and dangle incentives like a crypto sign-up bonus to bring in new users. The gap between P2P platforms and traditional exchanges is shrinking. Now, many leading exchanges mix their P2P crypto marketplace with advanced features, so you can jump straight from a peer-to-peer deal into spot or even derivatives trading.

This shift is blurring the line between P2P and full-on crypto margin trading exchanges. It’s just easier now to buy crypto locally, then put it to work across different trading products instantly, all without getting overwhelmed by extra fees.

Where to Trade P2P: Best P2P Crypto Exchanges by VentureBurn Top Picks

Here are some of the best p2p crypto exchanges compiled by VentureBurn:

| Platform | Fees (P2P) | Payment Methods | KYC Requirement | Escrow Service | Best For |

| Best Wallet | Free | Bank transfer, credit/debit cards, e-wallets (PayPal, Apple/Google Pay, etc.) | No KYC for basic use | Yes | Overall Best P2P Crypto Experience |

| MEXC | Free | Bank transfers & local methods via P2P and crypto transfers | Yes | Yes | Best No-Fees P2P Exchange |

| OKX | Free | Bank transfers, cards, wide P2P payment options | Yes (tiered) | Yes | Best P2P Crypto Exchange for Variety of Payment Methods |

| Binance | 0% for takers, 0.15% for makers | Cards, bank, many P2P local methods | Yes (most regions) | Yes | Largest P2P Crypto Exchange by User Base |

| Bybit | Free | P2P local fiat methods, cards (varies by region) | Yes | Yes | Best P2P Crypto Exchange for Fast Trades |

| BingX | Free | Bank transfers, cards, many P2P fiat options | Optional for basic services | Yes | Best Anonymous P2P Exchange |

| KuCoin | Free | Bank transfers & cards via P2P and crypto | Optional / basic P2P | Yes | Best Peer-to-Peer Crypto Exchange for Global Traders |

| Bitget | Free | Bank/card via P2P | Yes (most features) | Yes | Best Crypto P2P Exchange for 24/7 Customer Support |

| CoinEx | Free | Bank transfers & cards via P2P | No basic KYC | Yes | Top P2P Crypto Exchange for Vast Crypto Support |

| Uniswap | Free | Crypto only (DEX from wallet) | No | No | Best P2P Crypto Exchange for ERC-20 Tokens |

10 Best Exchanges for Crypto Arbitrage Reviewed: Finding the Best Arbitrage Trading Platform

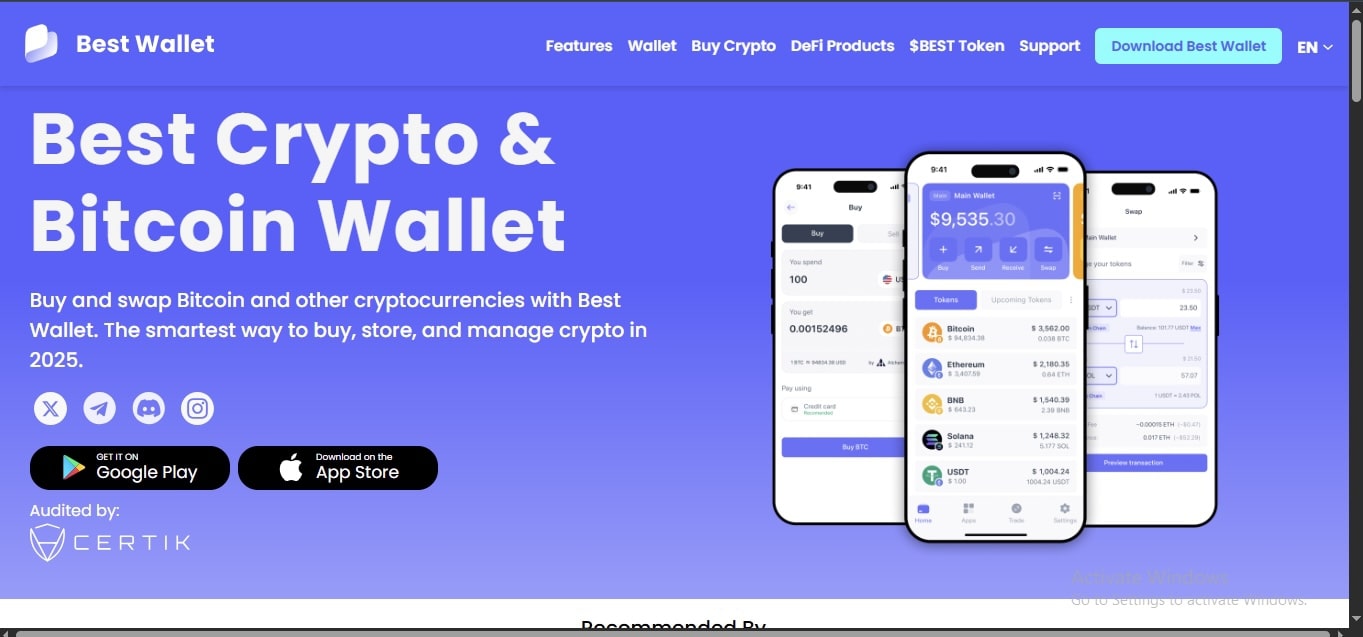

Best Wallet – Overall Best P2P Crypto Experience

Best Wallet puts mobile users first, mixing a crypto wallet with a built-in P2P marketplace. You can buy crypto using all sorts of local payment methods—and you don’t have to go through KYC unless you want to.

P2P Trading Conditions

Fee structure: No trading fees for P2P deals. Just pay network costs or the spread.

Payment methods: Plenty of payment choices—bank transfer, PayPal, cards, even local e-wallets.

Dispute resolution speed: Disputes get sorted at a moderate pace, depending on the platform’s support team.

Supported coins: You’ll find over 1,000 coins and tokens here.

Merchant verification: Merchant safety relies on reputation scores, not strict verification.

Pros

- No trading fees for P2P.

- Tons of payment options.

- Super easy for beginners.

- Wallet and exchange together in one place.

Cons

- Disputes might take longer to resolve than on big exchanges.

- Liquidity varies depending on where you are.

- Not as well-known globally as some major players.

- Advanced traders might find the tools a bit basic.

MEXC – Best No-Fees P2P Exchange

MEXC stands out for its huge list of altcoins and almost always has zero fees for spot and P2P trades.

P2P Trading Conditions

Fee structure: No fees for P2P trades.

Payment methods: 30+ ways to pay, like bank transfer and mobile payments.

Dispute resolution speed: Disputes handled at normal exchange speed.

Supported coins: Supports BTC, ETH, USDT, USDC for basic P2P.

Merchant verification: Merchants are sorted into tiers with some limits.

Pros

- Zero P2P fees.

- Thousands of listed altcoins.

- High liquidity for major pairs.

- Solid mobile app.

Cons

- Some countries have regulatory headaches.

- Fewer payment options than the top exchanges.

- Customer support isn’t exactly fast.

- P2P liquidity can be thin at times.

OKX – Best P2P Crypto Exchange for Variety of Payment Methods

OKX gives you both advanced trading tools and a strong P2P setup, usually without any P2P trading fee.

P2P Trading Conditions

Fee structure: Zero or very low P2P fees especially when using an OKX referral code

Payment methods: 900+ payment methods, including global options and bank transfer.

Dispute resolution speed: Dispute support is generally reliable.

Supported coins: BTC, ETH, USDT, and more available through Express Buy.

Merchant verification: Merchants go through standard verification tiers.

Pros

- No fees for most P2P trades.

- Huge variety of payment options.

- Deep liquidity thanks to users worldwide.

- Spot and derivatives markets are all in one place.

Cons

- Some areas report issues supporting NGN.

- Documentation can be a bit much to go through.

- Customer support changes depending on your region.

- Full features need KYC.

Binance – Largest P2P Crypto Exchange by User Base

Binance P2P is basically the go-to for peer-to-peer crypto trading worldwide. It’s got deep liquidity and supports tons of fiat currencies. For more info on Binance, make sure to check out our Binance review.

P2P Trading Conditions

Fee structure: No fees for most P2P trades. Makers might pay up to about 0.35% with discounts for users with Binance referral code.

Payment methods: 300+ payment methods—bank transfer, PayPal, mobile money, you name it.

Dispute resolution speed: Disputes get sorted fast since they have a big support team.

Supported coins: Plenty of supported coins: BTC, ETH, BNB, USDT, DAI, and more.

Merchant verification: Merchants go through verification and get reputation scores.

Pros

- Probably the deepest P2P liquidity out there.

- Loads of payment options.

- Strong escrow protection.

- Disputes are usually resolved quickly.

Cons

- KYC is a must for most features.

- Fees aren’t always the same.

- Regulatory issues can block access in some countries.

- The platform can feel overwhelming if you’re new.

Bybit – Best P2P Crypto Exchange for Fast Trades

Bybit brings together solid derivatives trading and a P2P marketplace, where you usually pay no trading fees at all. If you’re also looking for a P2P trading platform for fast trades, then Bybit is the perfect choice.

P2P Trading Conditions

Fee structure: Most of the time, P2P trades are free.

Payment Methods: Over 60 fiat options.

Dispute resolution speed: Fast, reliable support—pretty much what you’d expect from a top exchange.

Supported Coins: BTC, ETH, USDT, USDC.

Merchant Verification: Tiered, with verified sellers.

Pros

- No P2P trading fees.

- Robust derivatives platform.

- Quick trades and smooth interface.

- Trusted reputation.

Cons

- Not as many coins as Binance.

- You need KYC for full access.

- Payment options aren’t as broad as the big names.

- Support speed sometimes varies.

BingX – Best Anonymous P2P Exchange

BingX stands out by blending P2P with social trading and automated bots, but the P2P side is still pretty straightforward.

P2P Trading Conditions

Fee structure: Zero for P2P.

Payment Methods: More than 300 ways to pay.

Dispute resolution speed: Average speed.

Supported Coins: Mainly USDT.

Merchant Verification: Basic level required.

Pros

- Tons of payment options.

- Social and copy trading built in.

- Beginner-friendly pricing.

- No P2P fees.

Cons

- Only USDT is offered in P2P.

- Lower liquidity on P2P trades.

- Not as established as Binance.

- Support can be a bit slow.

KuCoin – Best Peer-to-Peer Crypto Exchange for Global Traders

KuCoin’s P2P platform supports lots of fiat payment options and charges no trading fees. Merchant limits depend on your verification level. KuCoin also caters to their global audience by making p2p trading very easy.

P2P Trading Conditions

Fee structure: Zero P2P fees.

Payment Methods: 100+ fiat/payment ways.

Dispute resolution speed: Generally good, but some users have seen delays.

Supported Coins: BTC, ETH, KCS, USDT, USDC.

Merchant Verification: Tied to your KYC tier.

Pros

- Free P2P trading.

- Huge range of payment options.

- Solid altcoin selection.

- Optional KYC lets you stay flexible.

Cons

- Lower P2P volume than Binance.

- Some service interruptions in Nigeria.

- Support can be hit or miss.

- Limits on P2P until you’re verified.

Bitget – Best Crypto P2P Exchange for 24/7 Customer Support

Bitget is a p2p trading platform that is well known for its 24/7 customer support. Bybit mixes high-powered copy trading with a P2P system and a good spread of fiat options.

P2P Trading Conditions

Fee structure : No P2P trading fees for those using Bitget referral code.

Payment Methods: 50+ including banks and e-wallets.

Dispute resolution speed: Exchange-level support.

Supported Coins: BTC, ETH, USDT, USDC, DAI, WLD, BGB.

Merchant Verification: Only verified traders.

Pros

- Supports lots of coins.

- P2P trading is competitive.

- Great for derivatives fans.

- User-friendly interface.

- 24/7 customer support

Cons

- P2P liquidity lags behind the biggest names.

- Full features require KYC.

- There are fees on spot trades.

- Customer support might be slow.

CoinEx – Top P2P Crypto Exchange for Vast Crypto Support

CoinEx keeps things basic with simple P2P trading, low fees and just the essentials for coins and payment methods.

P2P Trading Conditions

Fee structure: No trading fees.

Payment Methods: 10+ fiat choices.

Dispute resolution speed: Standard response times.

Supported Coins: USDT, USDC.

Merchant Verification: Sellers must be verified.

Pros

- No P2P fees at all.

- Super easy for beginners.

- Basic payment methods covered.

- Very low entry barrier.

Cons

- Only a few cryptos are supported.

- Not many payment options.

- Liquidity is on the low side.

- Features may look to simple for advanced traders

Uniswap – Best P2P Crypto Exchange for ERC-20 Tokens

Uniswap is the heavyweight DEX, letting you swap ERC-20 tokens straight from your wallet with no order books or custodians.

P2P Trading Conditions

Fee structure: Protocol charges (about 0.05–1%) plus gas fees.

Payment Methods: Crypto only—wallet to DEX.

Dispute resolution speed: Not really a thing; it’s all smart contracts.

Supported Coins: 600+ ERC-20 tokens.

Merchant Verification: None. It’s fully decentralized.

Pros

- No KYC required.

- Completely decentralized.

- Huge range of tokens.

- Deep liquidity across pools.

Cons

- Gas fees can get expensive.

- No support for fiat.

- No way to resolve disputes traditionally.

- You have to watch out for scam tokens.

What Is a Peer-to-Peer Crypto Exchange?

A peer to peer crypto exchange is a digital marketplace where users get the chance to trade cryptocurrency with each other directly, all the while avoiding intermediation from a central body holding the funds. P2P exchanges are widely used to buy crypto p2p, especially Bitcoin and stablecoins. Some platforms operate as a no kyc p2p crypto exchange, appealing to users prioritizing privacy. However, autonomy also comes with increased responsibility.

The Basics of P2P Trading

P2P trading involves two individuals exchanging crypto based on mutually agreed terms rather than an automated order book. The platform provides listings, escrow, and communication tools, but does not partake in the execution of trades.

Users can either browse existing offers or create custom ones. This flexibility supports advanced strategies like crypto arbitrage p2p, where traders exploit regional price differences. CoinDesk notes that such inefficiencies are more common in P2P markets.

Because there is no central counterparty, trust mechanisms are critical. The safest p2p crypto exchange platforms rely on reputation scores, trade history, and escrow systems. These tools help reduce bad actors without central custody.

The P2P Transaction: How it Works

A P2P transaction begins when a buyer selects an offer or accepts a seller’s terms. Once initiated, the seller’s crypto is locked in escrow by the p2p trading platform. This prevents premature fund release or cancellation abuse.

The buyer then completes payment using the agreed method and marks the transaction as paid. After verification, the seller confirms receipt, triggering the escrow release. This step-by-step process is standard across the best p2p crypto exchanges.

If a dispute arises, evidence such as payment receipts is reviewed. While not as robust as centralized customer service, this process provides structure. Understanding each step helps users avoid common p2p crypto scams.

The Role of Escrow Services

Escrow services are essential for trust in any peer to peer crypto exchange. They temporarily hold crypto assets until both parties meet agreed conditions. This system is widely documented by Binance Academy and blockchain security researchers.

Without escrow, P2P trading would rely entirely on trust, significantly increasing fraud risk. The best p2p bitcoin exchange platforms use automated, non-custodial escrow mechanisms. These reduce manipulation and human bias.

However, escrow is not foolproof. Users must still verify payments carefully and follow platform rules. Escrow reduces risk but does not eliminate the need for due diligence in p2p trading.

Benefits of Using P2P Bitcoin Exchanges

The benefits are compelling, and below are some key reasons why many traders prefer using P2P Bitcoin exchanges.

Avoid Centralized Platforms

By using a peer to peer crypto exchange, traders retain control until a transaction is completed. This aligns with the original design principles of blockchain technology. Ownership remains decentralized.

For many users, this is the deciding factor when choosing the best peer to peer crypto exchange. Trust shifts from institutions to transparent systems and individual verification.

More Payment Options

P2P platforms support a wide range of local and global payment methods. These include bank transfers, mobile money, e-wallets, and sometimes cash equivalents. This flexibility is widely cited as a key P2P advantage.

More payment options make it easier to buy crypto p2p in underserved regions. Users are not limited to international banking rails or credit cards. This expands financial inclusion, however, payment diversity also introduces risk.

Lower Fees (Zero Fees)

Many P2P platforms operate on zero or near-zero trading fees. Since there is no centralized order book or custody infrastructure, costs are reduced. This is confirmed by multiple exchange fee analyses.

Reduced fees are more beneficial to the profitability of high-frequency and arbitrage traders. The crypto arbitrage p2p strategies are the most beneficial to low transaction costs. Every saved fee compounds over time.

Fast Transaction Speeds

Transaction speed in P2P trading depends largely on payment method efficiency. Instant transfers can lead to near-immediate crypto release. In some cases, this rivals centralized exchange withdrawals because trades execute directly between users and there is no order matching delay. This makes p2p trading platforms efficient for time-sensitive transactions. Speed improves when trading with experienced users.

Delays usually occur due to human factors, not system limitations. Choosing reliable counterparties enhances consistency. This is a key trait of the safest p2p crypto exchange environments.

The Risks of P2P Crypto Exchanges

The risks are important to consider, and below are some key challenges associated with using P2P crypto exchanges.

Fraud and Scams

P2P crypto scams are a documented issue in peer-to-peer markets. Common tactics include fake payment confirmations and chargeback abuse. Chainalysis reports that social engineering plays a major role.

Scammers frequently prey on new users by creating a sense of urgency and manipulating users into making mistakes. While escrow mitigates this risk, it only does so when used properly. You should avoid making the mistake of releasing the crypto too early.

Using well-known platforms makes the risk far less. The best p2p crypto exchanges offer excellent services and are actively engaged in monitoring potentially harmful activities and alerting their users.

Counterparty Risk and Lack of Dispute Resolution

In P2P trading, each transaction depends on another individual’s honesty. If a dispute arises, outcomes depend on evidence and platform rules. There is no guaranteed resolution.

Unlike centralized exchanges, support teams act as moderators rather than arbiters. This can result in slower or inconclusive outcomes. Counterparty risk is inherent in P2P systems.

To reduce exposure, trade with verified, high-rating users. Choosing the best peer to peer crypto exchange improves dispute handling quality and transparency.

Security Vulnerabilities

The list of security risks present on P2P exchanges are phishing scams, impersonating accounts, fake support messages, and compromised accounts. These threats are present and documented in the security research of the blockchain.

Some platforms have experienced the exploitation of escrow and smart contracts and, therefore, underscore the importance of using reliable and audited services. The security of the platform is as much of a concern as the actions of the users.

To keep the P2P trading as secure as possible, the users need to step up security features like strong passwords, verification checks, or cautious messages. When executed properly, P2P trading is both powerful and secure.

P2P Exchanges vs. OTC Exchanges

P2P exchanges connect buyers and sellers directly on a platform that holds crypto in escrow until payment is confirmed. For example, you can use Binance P2P platforms, where you could purchase 0.5 BTC using bank transfer, and the cryptocurrency would be sent over to you after the transfer is verified. These platforms are suitable for small to medium volume trades, as they provide different functionalities, offer more privacy, and are more efficient.

OTC exchanges handle large-volume trades privately through brokers or liquidity desks, avoiding public order books and sudden price swings. Example includes Cumberland, where an investor can purchase $500,000 worth of ETH discreetly. OTC trading proves most valuable for larger transactions as it offers more flexibility, improved efficiency when executing, and decreased slippage.

Key Differences

| Differences | P2P Exchanges | OTC Exchanges |

| Trade Method | Direct peer-to-peer trading through a platform with escrow | Private trading through brokers or liquidity desks |

| Trade Size | Small to medium transactions | Large-volume, high-value transactions |

| Privacy | Moderate; depends on platform and KYC requirements | High; trades are private and discreet |

| Market Impact | Trades may slightly affect market prices | Minimal impact; avoids public order books |

| Best For | Everyday traders seeking flexibility and fast transactions | Institutional or high-net-worth traders needing discretion |

How to Trade on a P2P Crypto Exchange (Step-by-Step)

Step 1: Create a New Account & Complete Security

Sign up on the P2P trading platform and secure your account with strong passwords, two-factor authentication (2FA), and any required verification. Proper security setup protects your funds and trading history.

Step 2: Select a reputable merchant (Check feedback/completion rate)

Pick a vendor or purchaser that has very good feedback and a high completion ratio. Trustworthy sellers and buyers mitigate counterparty risk and are key in safe peer to peer trading.

Step 3: Place an order (Lock the price)

Enter the trade amount and confirm the order to lock in the price. Once locked, the crypto is placed in escrow and cannot be moved by the seller.

Step 4: Send payment via bank app (Do not mention “Crypto” in remarks)

Complete the payment using the agreed method through your banking or payment app. Do not mention “crypto” or related terms in the payment remarks to avoid transaction issues.

Step 5: Mark as “Paid” & Wait for Release

After sending payment, mark the order as “Paid” and wait for the seller to confirm. Once verified, the escrow releases the crypto to your wallet.

Methodology: How we Ranked the Best P2P Crypto Exchanges

We want our rankings to feel fair and actually help real people, not just look good on paper. So, we judged each P2P crypto exchange with criteria that matter to everyday users. Instead of just listening to marketing hype, we looked at how each platform actually works when you’re trading peer-to-peer. Here’s what we paid attention to:

Supported P2P Markets : Fiat currency coverage.

First, we checked how many fiat currencies each exchange supports in their P2P marketplace and how easy it is to access those markets from different regions. Exchanges that cover a lot of currencies like USD, EUR, NGN, INR, and so on, scored higher, since that means more people can buy and sell crypto locally without using third party exchanges for currency conversions. We also made sure these fiat markets are active, not just sitting there unused.

Available Payment Methods : Flexibility for users.

Next, we looked at how many payment options each platform gives you. Things like bank transfers, mobile money, e-wallets, cards, and even regional methods. If an exchange lets you use lots of different ways to pay (both local and global) it ranked higher. More options mean you get to pick whatever is the fastest, easiest, or cheapest for you.

Security : Escrow quality and merchant verification standards.

Security matters a lot in P2P trading, so we dug into each exchange’s escrow system and merchant checks to find out the safest p2p crypto exchange. We gave top marks to platforms that lock seller funds automatically during trades, have a clear way to handle disputes, and require merchant verification or use reputation systems (like trade history, completion rates, and user reviews). If an exchange had a confusing escrow protection, we ranked it lower, nobody wants to risk their money.

Ease of Use : Mobile app quality and flow.

Since most P2P users trade on their phones, we paid close attention to mobile app quality. We looked at stability, speed, how easy it is to find offers, and whether the steps to complete a trade actually make sense. Platforms with clean layouts, smooth navigation, and reliable apps did better, since they help people avoid mistakes and make trading feel a lot smoother.

Conclusion: What Is The Best P2P Crypto Platform in 2025?

Picking the best P2P crypto platform in 2025 really comes down to what you want as a user. Some people want deep liquidity and lots of fiat options, especially if you’re into crypto arbitrage P2P. That’s where tight spreads and quick settlements can influence your profits.

But you can’t ignore security. Solid escrow systems and verified merchant programs aren’t just nice to have anymore, they actually protect you from P2P crypto scams out there. If privacy matters to you, you might lean towards a no KYC P2P crypto exchange. Even then, you want to see clear dispute resolution and a solid reputation system in place. So, the best p2p crypto exchanges these days find a way to balance liquidity, security, flexibility, and privacy because nobody wants to compromise too much on any of those.

FAQs: P2P Crypto Marketplace Guide

What is a P2P crypto marketplace and how does it work?

A P2P crypto marketplace lets people trade cryptocurrencies directly with each other and no middleman is involved. It has become a go-to choice for anyone who wants more control, local payment methods, and extra flexibility when you want to buy crypto P2P.

Is P2P crypto trading safe from scams?

P2P trading is pretty safe when you practice good habits, but P2P crypto scams still exist. Stick with platforms that use solid escrow, work with verified merchants, and make it easy to resolve disputes.

Which platform is the best P2P Bitcoin exchange in 2025?

The best P2P Bitcoin exchange really comes down to where you live and what you want from trading. Still, the top platforms usually bring high liquidity, quick dispute handling, and lots of ways to pay with different currencies.

Can I use P2P crypto platforms for crypto arbitrage?

Absolutely. A lot of traders use P2P platforms for crypto arbitrage P2P. This helps to spot price gaps between different regions, payment options, or exchanges and turn a profit.

Do I need KYC to buy crypto on a P2P marketplace?

Not every time. Some platforms operate as a no KYC P2P crypto exchange, so you can trade with little or even no identity checks.

The post 10 Best P2P Crypto Exchanges for Zero-Fee Trading in 2026 appeared first on Ventureburn.