Crypto prop trading firms have become the new frontier for skilled traders who want to access significant capital without risking their own savings. In 2025, the market exploded, exceeding $20 billion, setting up the market for even bigger growth in 2026.

As crypto prop trading is now more competitive, regulated, and trader-friendly than ever, firms now offer instant funding, higher leverage, better risk management tools, and access to professional-grade trading platforms like MT5, cTrader, and TradingView.

Whether you’re a scalper or swing trader, there’s a crypto prop trading firm for you. In this article, we review the 10 top rated crypto prop trading firms in 2026, comparing their funding options, profit splits, leverage, and platform support to help you pick the best crypto prop firm that meets your demands.

Where to Get Funded: Best Crypto Prop Trading Firms by VentureBurn Top Picks

Getting the funds necessary to scale your crypto trading isn’t a huge task anymore. These are Ventureburn’s top picks for crypto prop trading firms that offer generous funding and trader-friendly rules.

| Prop Trading Firm | Profit Split | Account Size | Trading Platforms | Evaluation | Crypto Leverage |

| FX2 Funding | Up to 95% | $10k to $2M | MT5, cTrader, DXtrade | 1-Step | 2x |

| Hola Prime | Up to 95% | $5k to $4M | MT5, Match Trader, cTrader, DXtrade | 1-Step, 2-Step | 5x |

| FTMO | Up to 90% | $50k to $1M | MT4, MT5, cTrader | 2-Step | 3x |

| FundedNext | Up to 95% | $5k to $4M | MT4, MT5, cTrader | 1-Step, 2-Step | 1x |

| Crypto Fund Trader | Up to 90% | $10K to $300K | CFT, MT5, Bybit | 1-Step, 2-Step | Up to 100x |

| Funded Trading Plus | Up to 90% | $5k to $2.5M | MT4, MT5, DXtrade, cTrader, Match Trader | 1-Step, 2-Step, Instant | 2x |

| DNA Funded | Up to 90% | $5k to $600k | TradeLocker | 1-Step, 2-Step, Rapid | 2x |

| E8 Markets | 80% | $5k to $1M | TradeLocker, MatchTrader, cTrader, MT 5, MT4, TradeStation | 1-Step, 2-Step, 3-Step | 5x |

| PipFarm | Up to 95% | $5k to $1.5M | cTrader | 1-Step, 2-Step | 5x |

| HyroTrader | Up to 90% | $5k to $1M | Cleo, Bybit (demo) | 2-step | Up to 100x |

10 Best Crypto Prop Trading Firms Reviewed (2026 List)

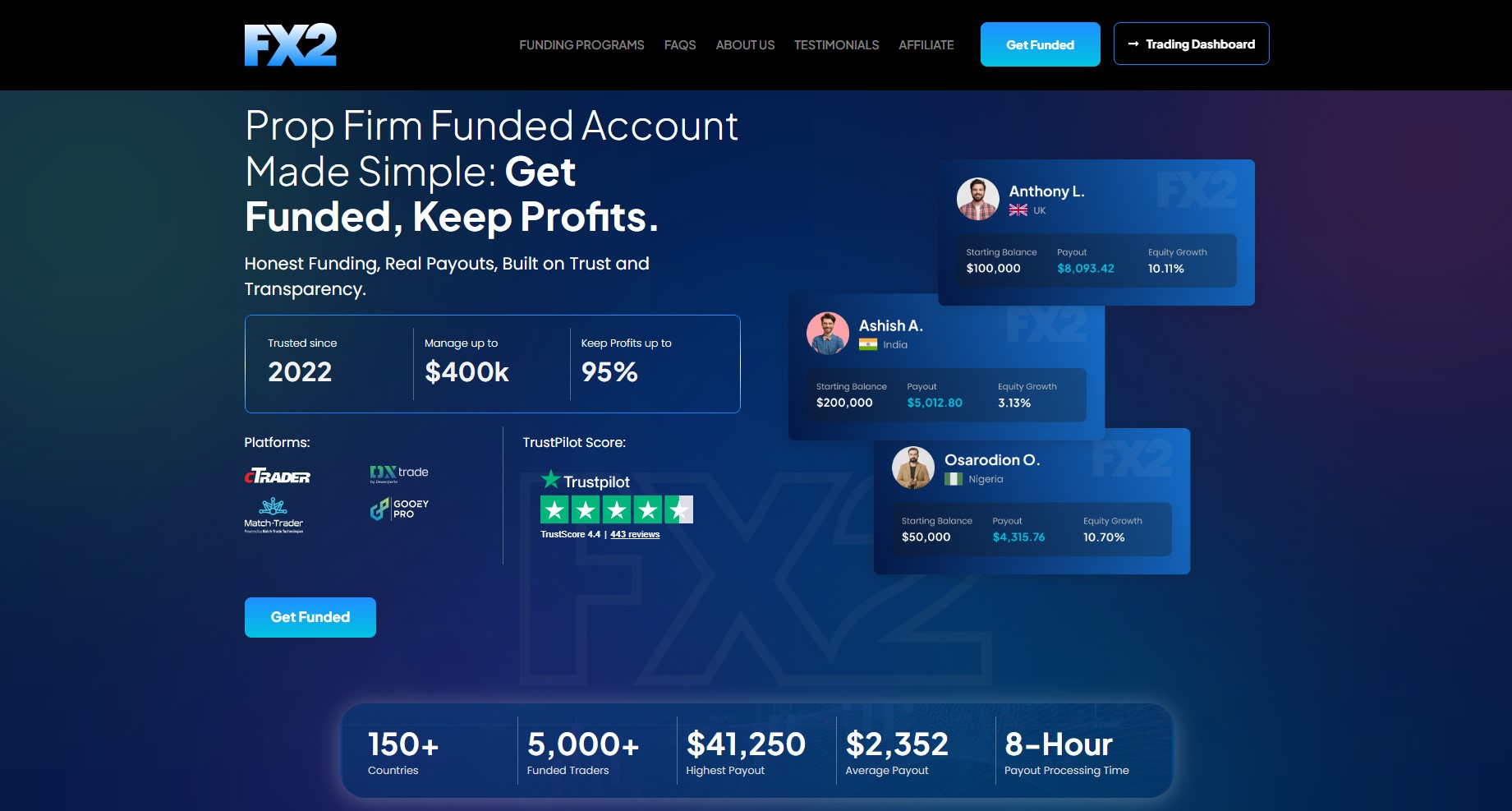

FX2 Funding – Best Crypto Prop Firm for Fast Order Execution

Founded in 2022, FX2 Funding has carved out a niche for itself by focusing heavily on technology and trader support. It has become popular for its optimized backend and instant order fills. They are particularly known for their simple, no-nonsense evaluation rules, which are designed to pass skilled traders rather than trip them up on technicalities.

It has a competitive pricing model and frequently offers discounts on evaluation challenges. The stability of their servers during high-impact news events makes them a top contender for crypto traders. They don’t have the highest leverage in the industry, but they make up for it with reliability.

FX2 Funding Key Features

Profit Split: 80/20 Standard (traders take 80%), up to 90% with an optional add-on.

Max Funding: $10k – $400k. Up to $2 million with scaling

Platforms: MT5, cTrader, DXtrade

Crypto Leverage: 1:2

Pros

- Excellent server stability during high volatility.

- Simple, transparent evaluation rules.

- No time limits on challenges.

- Fast payout processing.

Cons

- Smaller crypto pair selection.

- Smaller leverage for crypto.

Hola Prime – Best for High Leverage Crypto Prop Trading

Hola Prime is often cited as the “trader’s choice” because of its aggressive scaling plan and high-leverage options. They understand that crypto traders often require more room to maneuver, and their funding model reflects that. They offer more than 110 cryptocurrencies across a wide variety of platforms.

The platform also lead the industry in the speed of their payouts—sometimes in as little as 1 hour. They offer a variety of evaluation models, including a challenge for those who want lower entry fees and an instant funding model for pros who want to skip the tests. Their dashboard is modern and provides deep analytics on your trading performance.

Hola Prime Key Features

Profit Split: 80/20. Up to 95% (Loyalty bonuses)

Max Funding: $5k – $300k. Up to $4 million with scaling

Platforms: MT5, Match Trader, cTrader, DXtrade

Crypto Leverage: 1:5 on Bitcoin and Ethereum and 1:2 on other altcoins

Pros

- Good leverage.

- Quick onboarding.

- Competitive spreads.

- Ultra-fast payout.

- Generous scaling plan up to $4 million.

- Huge variety of trading platforms.

Cons

- Higher risk profile.

- Strict drawdown rules.

- Restriction on some aggressive trading strategies.

FTMO – The Industry Leader for Funded Crypto Traders

FTMO is one of the most popular prop firms, operating for more than 10 years. For crypto traders, FTMO offers safety and prestige. Their “Swing” account type is specifically designed for traders who hold positions over the weekend—a non-negotiable feature for serious crypto swing traders.

While they are primarily a forex-first firm, their crypto offering is quickly increasing and already includes more than 32 crypto pairs. Its transparent rules, strong reputation, and excellent support make it one of the top crypto prop firms for serious traders.

FTMO Key Features

Profit Split: 80/20. Up to 90% through scaling plan

Max Funding: $50k to $200k. Up to $1 million through scaling plan.

Platforms: MT4, MT5, cTrader

Crypto Leverage: 3x

Pros

- Detailed analytics.

- Great scaling plan options.

- Unmatched reputation and reliability.

- Weekend holding allowed on Swing accounts.

- Great educational content and trading psychology coaches.

Cons

- Higher challenge fees.

- Stricter evaluation rules.

FundedNext – Best Instant Funding Prop Firm Option

FundedNext was founded in 2022 and has disrupted the market by introducing the concept of “profit share from the challenge phase.” This means that even while you are proving your skills in the evaluation stage, you can earn a percentage of the profit you generate.

This feature alone attracts thousands of crypto traders who are tired of trading for free during evaluations. They are also one of the few firms that genuinely promise (and deliver) 24-hour payouts.

Their dedicated crypto infrastructure supports a wide range of pairs, and they allow news trading, which is essential for capturing the explosive moves often seen in the crypto market. While you cannot access the lowest fees crypto exchange on FundedNext, it supports nine crypto pairs on MT4, MT5, cTrader, and Match-Trader.

FundedNext Key Features

Profit Split: 60-95%, depending on tier

Max Funding: $5k to $300k. Up to $4 million through scaling.

Platforms: MT4, MT5, cTrader, Match-Trader

Crypto Leverage: 1x

Pros

- 15% profit from the challenge phase.

- No time limits on challenges.

- Instant funding available.

- Flexible programs.

- Fast payouts.

Cons

- Higher fees for instant funding.

- Limited crypto assets.

- Low leverage.

Crypto Fund Trader – Best Specialized Prop Trading Crypto Firm

Crypto Fund Trader is built specifically with the crypto native in mind. Unlike generalist firms that offer crypto as an afterthought, this firm prioritizes it. It offers a trading environment that mimics real crypto exchanges, often providing tighter spreads on altcoins than you would find on even the best decentralized crypto exchanges.

They allow you to trade more than 710 cryptocurrency pairs. This makes them the go-to firm for traders who specialize in altcoins or DeFi tokens. It also partners with Bybit, giving traders a chance to earn a crypto sign up bonus. Their evaluation process is straightforward, and they are very lenient regarding trading styles, allowing scalping and hedging.

Crypto Fund Trader Key Features

Profit Split: 80/20

Max Funding: Up to $300,000

Platforms: CFT Platform, MT5, and partners with Bybit.

Crypto Leverage: 100x

Pros

- Priority on cryptocurrencies.

- Widest crypto pairs.

- High leverage specifically for crypto pairs.

- Weekend holding allowed.

- Simple challenge rules.

- One-step evaluation option.

- Fast 24-hour payouts.

Cons

- Smaller funding caps.

- Platform options are limited.

Funded Trading Plus – Best Proprietary Trading Crypto Firm for Scaling

Funded Trading Plus is ideal for traders who want to start small and grow massively. It offers one of the most aggressive in the industry, allowing successful traders to double their account size rapidly. They utilize the DXtrade platform, which offers a cleaner UI and better charting tools than the aging MetaTrader.

They offer a single-phase evaluation and even an instant funding model where you can start earning from day one. For crypto traders, the ability to hold trades over the weekend without purchasing a special “swing” add-on is a significant advantage.

Funded Trading Plus Funding Key Features

Profit Split: 80/20. Up to 90% for traders with scaling.

Max Funding: $5k – $200k standard. Up to $2.5 million max.

Platforms: MT4, MT5, DXtrade, cTrader, Match Trader

Crypto Leverage: 2x

Pros

- Unlimited scaling potential.

- No time limits on evaluation phases.

- Instant funding options are available.

- Strong risk management with the new DXtrade platform.

- Weekend holding and news trading are allowed.

Cons

- Lower leverage.

- Longer payout cycles.

- Trailing drawdown rule can be tricky for beginners.

DNA Funded – Best Crypto Funded Account for Beginners

DNA Funded was launched in late 2024 and has quickly gained popularity due to its partnership with TradeLocker, a next-gen trading platform that integrates TradingView charts directly. For crypto traders who live and breathe TradingView, this is a game-changer. It removes the friction of analyzing on one screen and executing on another.

Their entry fees are very affordable, making them a perfect choice for beginners who want to test the waters of prop trading without a large financial commitment. They offer a simple 1-step evaluation and very transparent rules regarding drawdowns and profit targets.

DNA Funded Key Features

Profit Split: 80/20, up to 90% with boost.

Max Funding: $5k to $200k base, up to $600k with scaling.

Platforms: TradeLocker

Crypto Leverage: 2x

Pros

- Native TradingView integration via TradeLocker.

- Very low entry cost for challenges.

- Simple rules are ideal for new traders.

- Profit boost for traders.

Cons

- Low leverage.

- Smaller maximum funding limit.

E8 Markets – One of the Best Prop Firms for Crypto Evaluation

E8 Markets (formerly E8 Funding) is famous for its user-friendly dashboard and high degree of customization. They allow traders to essentially “build their own” evaluation criteria, adjusting drawdown limits and initial balances to suit their specific strategy. This flexibility is rare in the prop trading world.

For crypto traders, E8 offers a solid environment with MT5 and Match-Trader. They have a unique “E8 Track” program that offers a clear path to funding with reasonable objectives. Their technology is proprietary and top-tier, ensuring minimal slippage even during the wild swings characteristic of the crypto market.

E8 Markets Key Features

Profit Split: 80/20, up to 90% with scaling.

Max Funding: $5k to $500k. Up to $1M with scaling.

Platforms: TradeLocker, MatchTrader, cTrader, MT 5, MT4, TradeStation

Crypto Leverage: 5x (Bitcoin and Ethereum), 2x other altcoins

Pros

- Highly customizable evaluation parameters.

- Excellent, modern user dashboard.

- Fast, automated payouts in USDT.

- Clear rules.

Cons

- Two-step challenge.

- Drawdown rules are equity-based.

PipFarm – A Top Choice Among Best Prop Trading Firms

PipFarm is a rising star that prioritizes trader longevity. They have done away with the confusing “trailing drawdown” that kills so many accounts and replaced it with a static drawdown. This means your risk limit doesn’t move up as you make a profit, giving you much more breathing room to weather the inevitable drawdowns of crypto trading.

It operates exclusively on cTrader, which offers better execution, features, and risk management than MetaTrader. Their “Kill Zone” rules and other gamified elements incentivize good risk management without being predatory.

PipFarm Key Features

Profit Split: 70/30. Up to 95% with scaling.

Max Funding: $5k to $300k. Up to $1.5M with scaling.

Platforms: cTrader

Crypto Leverage: 5x

Pros

- Static drawdown (huge benefit for traders).

- High profit split potential.

- cTrader platform is excellent for execution.

- Great support for traders.

- Very fast payouts.

Cons

- Daily loss limit of 3% is strict.

- Only offers cTrader.

HyroTrader – Best Crypto Prop Trading Platform for Low Spreads

HyroTrader is arguably the most “crypto-native” firm on this list. The platform connects directly to some of the best crypto exchanges for liquidity (like ByBit and Binance feeds). This means you get raw crypto spreads and deep liquidity on over 700 crypto pairs, not just the majors.

They offer accounts denominated in USDT, which simplifies the banking process for crypto traders. Their evaluation is flexible, and because they tap into real exchange volume, they are far more tolerant of diverse trading strategies, including high-frequency trading and scalping.

HyroTrader Key Features

Profit Split: 70/30. Up to 90% for consistent traders.

Max Funding: Up to $200,000.

Platforms: Cleo, Bybit (demo)

Crypto Leverage: Up to 100x

Pros

- Raw spreads from major exchanges.

- Accounts denominated in USDT/USDC.

- Massive selection of altcoin pairs.

- Deep liquidity.

- Very high leverage, up to 100x.

- Simple 1-step evaluation process.

Cons

- Newer firm with a smaller track record.

- Limited trading platforms.

- Smaller account sizes.

What Are Crypto Prop Trading Firms?

Crypto prop trading firms are companies that provide capital to profitable cryptocurrency traders. Normally, you trade using your own money and bear 100 percent of the risk. In a prop firm structure, you pay a small fee to undertake an evaluation or challenge.

If you pass the evaluation, you receive money from the firm to trade. You no longer run the risk of losing your own money in trading. In return, you share the profits with the firm, usually 80-90 percent of your profits, with the firm retaining the other 10-20 percent.

How Do Crypto Prop Trading Firms Work?

Crypto prop trading firms or proprietary trading crypto operate based on a set industry standard.

- Challenge Phase: You buy a test account (e.g., $100 fee for a $10,000 account). You must trade this account and make a profit (usually 8-10%) without losing a certain amount (usually 5-10%).

- Verification Phase: Some firms have a second step to prove your first win wasn’t luck. The profit target is usually lower here (5%).

- Funded Trader Phase: Once you pass, you get a “live” account. This is often still a demo account with real data, but the firm pays you real money based on the performance.

- Payouts: You request a withdrawal at the close of a trading period (weekly, biweekly, or monthly). The company transfers your portion of the earnings through crypto (USDT, BTC) or bank transfer.

Why Do Traders Join Crypto Prop Firms?

The main reasons why traders join crypto prop firms are:

- Bigger Trading Capital: Normally, traders do not have the money to make big trades. Prop firms that trade crypto can give traders a lot of money, sometimes up to $100,000. This means traders can make trades and maybe even make more money.

- Lower Risks: When you work with a prop trading crypto firm, you do not use your money. This means the prop trading crypto firm has to deal with the risks of losing money, not you.

- Structured Trading Environment & Risk Management: Prop firms enforce strict rules and risk controls, such as daily loss limits and maximum drawdowns. This structured environment encourages discipline and helps traders avoid reckless, emotional decisions for consistent profitability.

- Access to Advanced Resources: The best prop trading firms give crypto traders access to institutional-grade trading platforms, cutting-edge algorithms, and the best crypto trading bot in the market.

- Trading with a crypto funded account has attractive profit-sharing models, with traders often keeping between 70% and 90% of the profits they generate.

How Does Crypto Prop Trading Differ From Traditional Prop Trading?

Traditional prop firms (such as on Wall Street) demand that you have a degree, pass interviews, and physically work in an office. They pay a salary plus a bonus. Any person with an internet connection can access crypto prop firms. There are often no background checks and no interviews.

The trading challenge is the interview. Moreover, traditional prop firms deal with stocks, futures, and forex. Crypto prop companies specialize in digital assets, and they provide 24/7 trading, unlike the traditional market.

Key Features to Look for in the Best Prop Firms for Crypto

Account Funding Sizes and Scalability

Find crypto prop trading firms that have a good growth strategy. You can begin with $10,000, but can you go to $100,000 or even to $1 million? The best prop trading firms have automated scaling strategies that will grow your capital by 25-50 percent after a few months if you are profitable and disciplined.

Trading Platforms with Real-Time Data

Crypto moves fast. You cannot afford to trade with slow information. Find crypto prop trading firms that provide TradeLocker or cTrader or those that are integrated with the best crypto exchanges with real-time feeds. Do not use companies with generic, slow white-label brokers.

Profit Splits and Payout Frequency

The industry standard is now 80%. Do not settle for less. Also, check the payout frequency. Net 30 terms are no longer applicable in crypto. Some of the best crypto prop trading firms make biweekly or even weekly payments.

Evaluation Challenge Rules

Read the fine print. Does the prop firm impose a deadline (e.g., pass each challenge within 30 days)? In 2026, this has been eliminated by most leading companies. Also, check the “drawdown” type. Reading the fine print of the challenge rules will help you spot any terms you are not comfortable with.

Allowed Trading Strategies

Trading crypto tends to be volatile. Ensure the firm allows:

- News Trading: Trading the CPI or NFP releases.

- Weekend Holding: Holding BTC or ETH during Saturday/Sunday.

- EAs/Bots: Applying the best crypto trading bot for automation.

How to Choose the Right Crypto Prop Trading Firm for You

Know Your Trading Style and Risk Tolerance

Are you a scalper nailing 1-minute BTC charts or a swing trader riding ETH waves for days? Your trading style and risk tolerance will influence the best crypto prop trading firm for you. Scalpers thrive with FX2 Funding’s lightning execution, swingers love FTMO’s weekend holds, while risk-risk traders choose Crypto Fund Trader’s 1:100 leverage for moonshot trades.

Reputation and Transparent Terms Matter

The cryptocurrency prop market is unregulated. The reputation of the firm is all you have. Only comply with firms that are at least 2 years old or supported by major brokerage liquidity. Visit Trustpilot, Check, and Discord to find current payout evidence.

Platform Technology and Trading Tools

Pick a platform that supports the technology and trading tools that you require to trade optimally. Also, check if the prop firm is integrated with the best crypto exchange for day trading to get access to real-time data. If you use TradingView for analysis, choose a firm like DNA Funded or Match-Trader brokers that integrate well with it.

Are Crypto Prop Firms Legit?

Yes, crypto prop firms are legitimate businesses registered in their respective jurisdictions. It is one of the fastest-growing markets, ballooning to over $20 billion in 2025. However, because it is an unregulated market, there are also scams and Ponzi-like companies, which make use of new fees to compensate old traders.

Crypto Prop Firms—Pros and Cons

While crypto prop firms offer higher capital and growth opportunities, they also come with their drawbacks.

Crypto Prop Firm Pros

- Access to Massive Capital: Trade up to $1 million, not from your personal funds.

- Limited Risk: You can only lose the challenge fee.

- Advanced Tools: Many crypto prop firms offer traders access to advanced tools.

- 24/7 Markets: Crypto allows you to trade weekends and holidays.

- Payouts in Crypto: Fast settlements in USDT/USDC.

Crypto Prop Firm Cons

- Strict Rules: A single bad day can result in breaking the daily loss limit and losing the account.

- Evaluation Fees: Failing can prove costly, as you lose your entire evaluation fee.

- Variable Spreads: Crypto Spreads on prop firms tend to be larger than on the best crypto margin trading exchanges like Binance or MEXC.

Best Prop Trading Firms for Crypto: Final Thoughts

In 2026, the opportunity for crypto traders to get funded in this $20+ billion market has never been better. The competition among firms has forced them to lower prices, increase profit splits, and remove annoying time limits.

For most crypto traders, HyroTrader and Crypto Fund Trader are the ideal picks because they specialize in crypto and offer a huge asset list. However, if you are just starting, DNA Funded offers a low-risk entry point. If you are an experienced veteran wanting maximum reliability, FTMO remains the king.

And if you want a pure crypto experience with high leverage and raw spreads, HyroTrader is the specialist you need. Success in prop trading isn’t just about finding the firm with the highest capital; it’s about finding the firm whose rules align with your strategy so you can keep that capital for the long term.

FAQs: Prop Firm Crypto Trading

Are crypto prop firms legal?

Yes, Prop firms are legal and duly registered as businesses. However, the market remains unregulated.

How Big Are the Funded Accounts?

Crypto prop firms provide traders with account sizes ranging from $5,000 to $1,000,000. The evaluation fee depends on the desired account size. You cannot change this after passing the verification phase.

Is it hard to pass a crypto prop firm challenge?

While the goals set in the crypto prop firm challenges are not outrageous, they are quite difficult to pass. It requires strict risk management, which not many traders have. As a result, statistics show that only about 5-10% of traders pass evaluations.

What is the best prop firm for crypto scalping?

HyroTrader and FX2 Funding are really good for scalping. This is because they focus on getting trades done quickly and have differences between the prices at which you can buy and sell.

Can I use bots or EAs for crypto prop trading?

Expert Advisors are allowed by firms but the thing to remember is that high-frequency trading and arbitrage bots are usually not allowed. Check with your crypto prop trading firm about the kind of bot it supports.

Do I need to pay taxes on prop firm earnings?

You are basically working on your own as a contractor. The company gives you the amount of money they owe you and then you have to deal with reporting that money and paying your taxes where you live.

The post 10 Top Rated Crypto Prop Trading Firms in 2026 appeared first on Ventureburn.